Capital Rise and Investor Portal

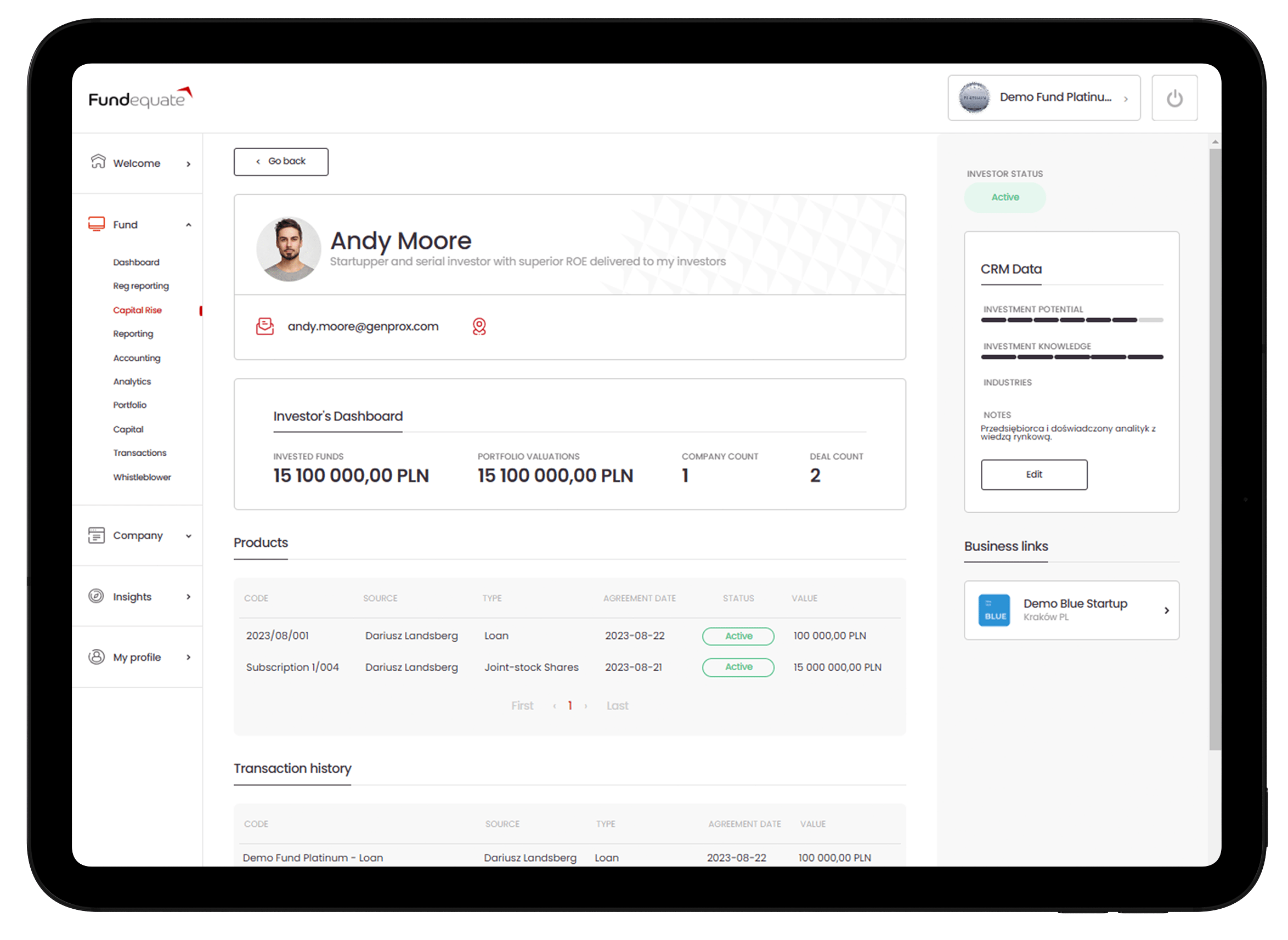

Issue your VC fund shares along with a share allocation mechanism for investors. Onboard your investors via custmised Investor panel allowing for the recording of issuance and ongoing communication with alternative fund investors.

Information campaigns and investment campaigns enabling the building of lead databases for new capital calls, both for Venture Capital funds based on equity financing and investment companies based on debt financing.

- Dedicated investment campaigns

- Share issuances and shareholder registry

- Debt financing and repayment schedule

- Sales network management and commission settlements

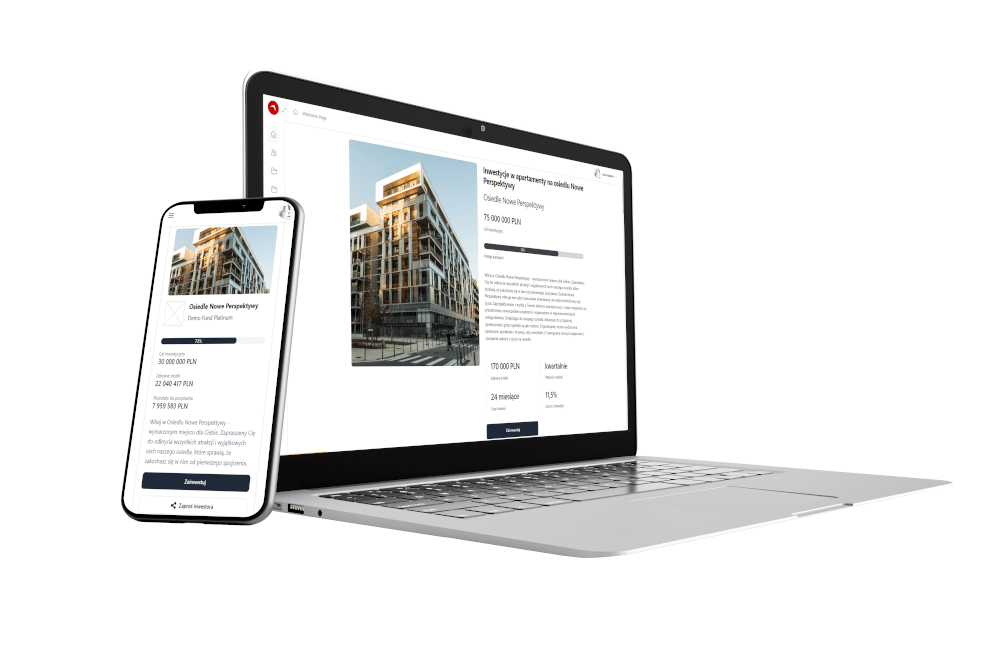

- Investor onboarding in a white-label model

- Investor panel and advisor panel available online

- Integration with accounting system and settlements

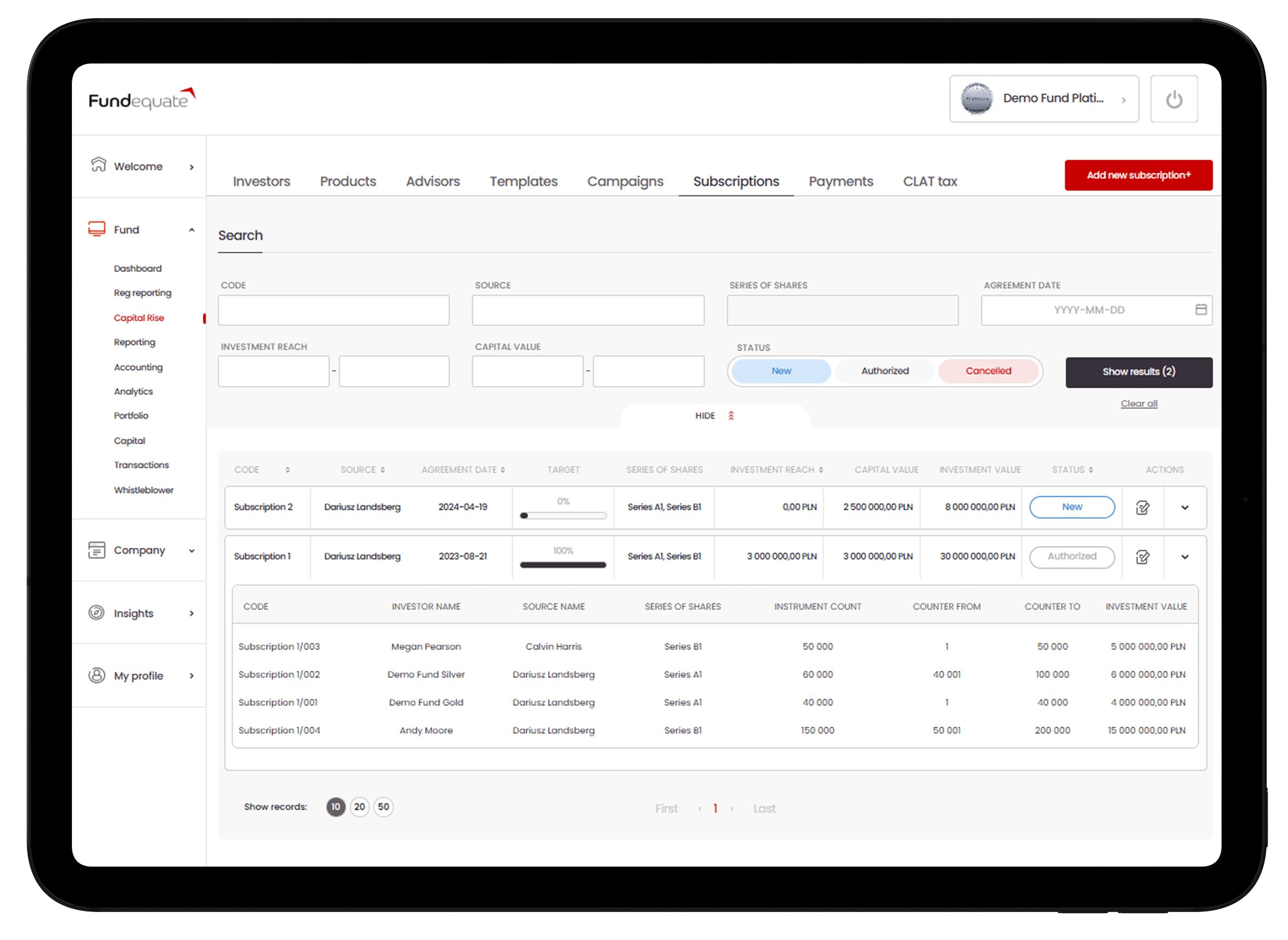

Share issuance and Capital Call

The Capital Rise module allows for the issuance of shares of the VC fund and investor onboarding, as well as directing information to them about subsequent capital increases (Capital Calls). Recording of individual share subscriptions along with their allocation to specific investors and online access to the shareholder register of the VC fund.

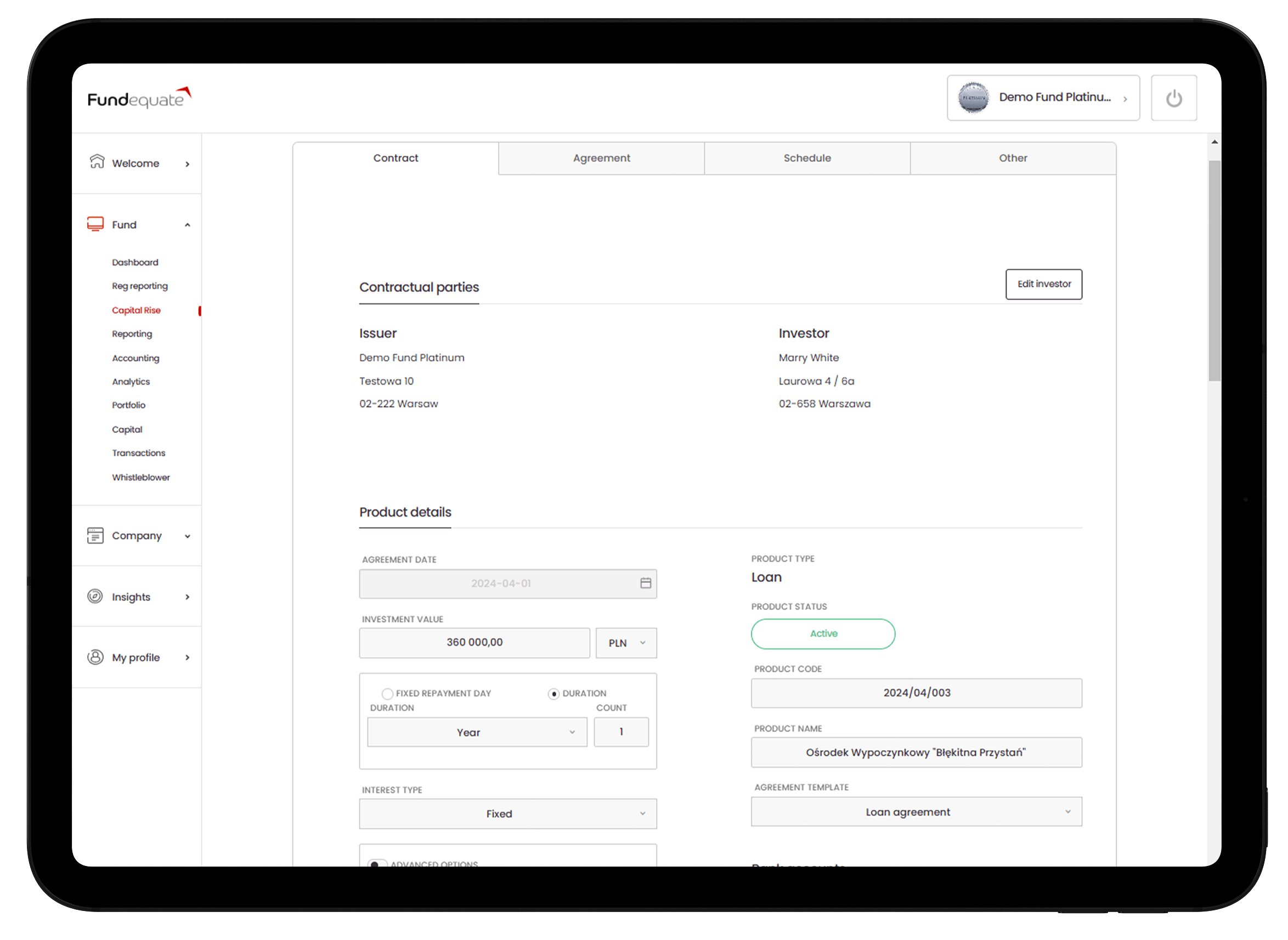

Debt issuance and sales management

For investment companies (SVP in the real estate industry), Fundequate offers a fully configurable module enabling the issuance of investment loans, automated contract signing, payment reconciliation, and automatically generated schedules. Automating interest payments and PCC will allow you to streamline processes more efficiently, thereby reducing support department costs.

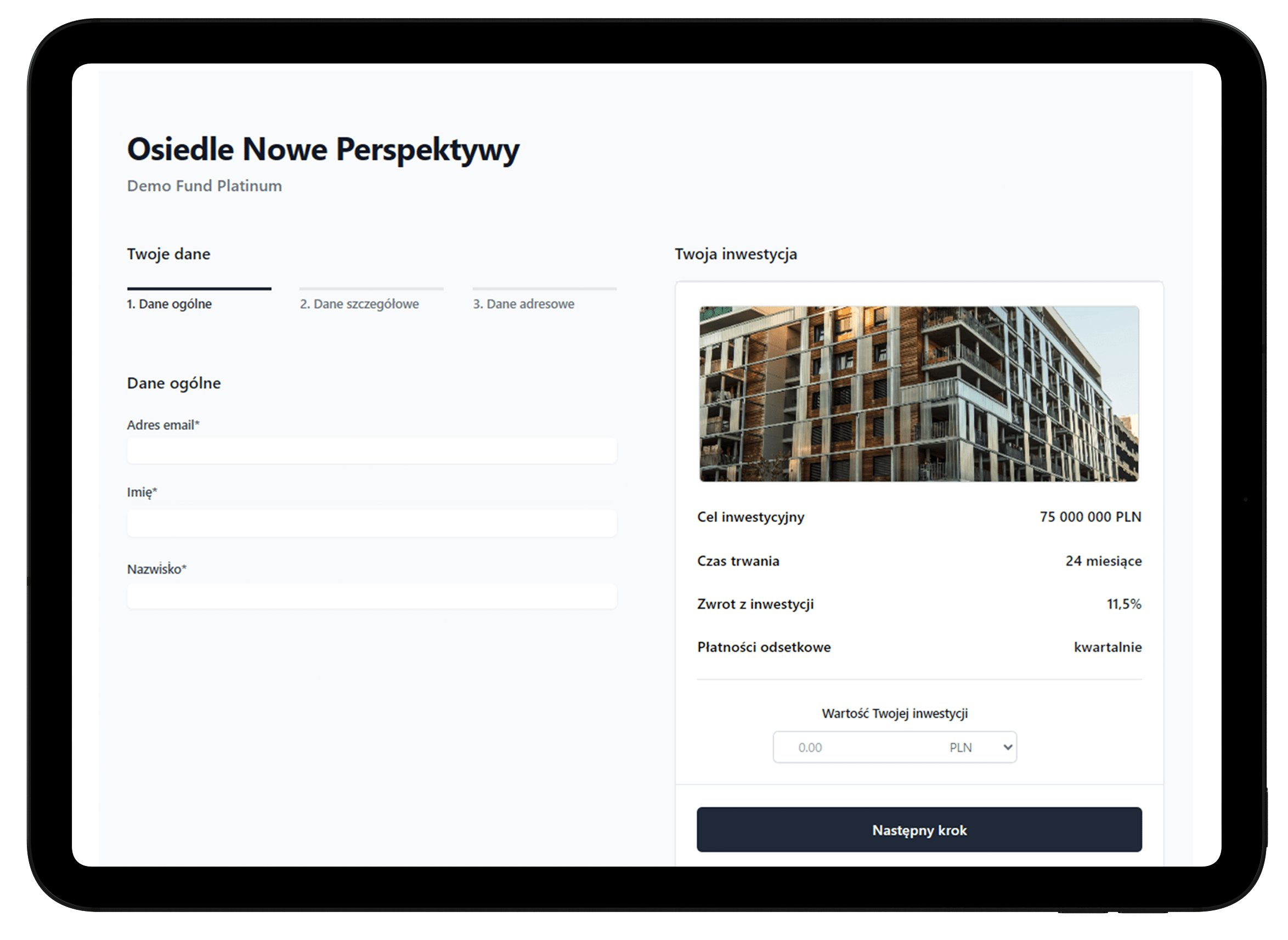

Dedicated investment campaigns

Creating compelling informational campaigns to generate leads for the distribution of shares or debt instruments. Establishing and managing a sales network along with analytics on the sales performance of individual client advisors. Campaigns available in a white-label version along with an Investor Portal enabling online access and real-time communication with investors.

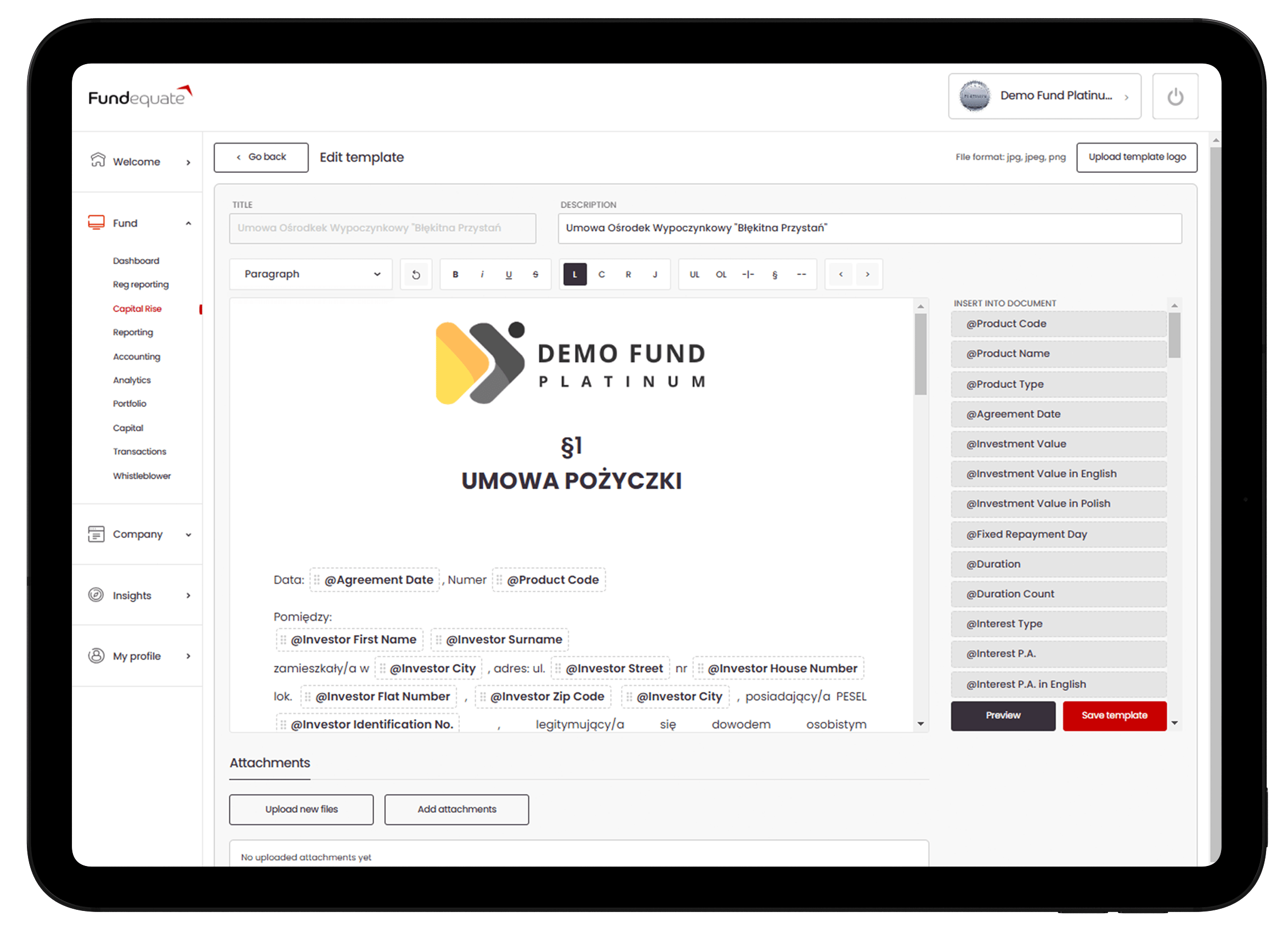

Automation of service process

The Contract Wizard enables the creation of any document using dynamic tags, allowing for the creation of templates for all types of contracts and automating the process of their generation and conclusion. The contract generation process is integrated with investment campaigns, eliminating the risk of errors on the operations side and significantly speeding up the contract signing process.

Investor CRM data management

Gain access to your investors’ and leads’ CRM data in one place and manage the risk profile of your fund or investment company by profiling users and conducting suitability surveys filled out during the investor onboarding process.

Let's discuss how Fundequate can support your business

Schedule a demo session or get in touch with us to learn more about how

Fundequate can support capital acquisition for your investments.